Many top producers have been consistent in their business for years. Do you know what that one simple concept the top producers are doing? In this episode, Tim Davis, the Vice President of Strategic Growth and Internal Coaching at Atlantic Bay Mortgage Group, unravels that secret and explains how it works. Their secret is the circle of referrals system, which he has turned into a book. It is a life-changing concept encompassing three things: educate, appreciate, and ask. Tim’s success as an originator allows him to provide profound insights to educate people and help them grow personally and professionally through The Originators Guide. Dive into this episode and learn this simple solution to grow your business.

—

Watch the episode here

The Circle Of Referrals Book And Originators Guide Magazine With Tim Davis Of Atlantic Bay Mortgage

I’m excited to have a special guest on. His name is Tim Davis and he is with Atlantic Bay Mortgage Group. He’s a very successful individual. He has had a great career as a coach and working in so many areas. For those of you that are business owners, the importance of having an internal coach inside of your company. Tim is that. Also, he does things outside of Atlantic Bay by permission of Atlantic Bay and is in agreement with Atlantic Bay. We can’t wait to get into it. Tim, welcome to the program.

It is fantastic to be here. I appreciate you having me on, David.

Joining me in this interview is my co-host Marc Helm. Marc, thanks for dialing in and being here with us as well.

I’m glad to be here, David.

You bet. I’m reading your bio, Tim. One of the things that leaped out is that Tim was an at-risk kid from the housing projects that got introduced to the mortgage business. Tim, that sounds like such an interesting background you came out of poverty and at risk. Talk a little bit about that. Give us a little bit of a story about your journey into mortgage lending.

When I was three years old, my father passed away so my mom raised me. The challenge she faced was twofold. She had a sixth-grade education and a prescription drug problem, so it was a compounded issue. She did the best she could. We lived on $618 a month in the housing projects in a small town in Kentucky. At sixteen years old, I walked out the door and got a job. I started bagging groceries at a grocery store. Back then, David, when you bag someone’s groceries and you took them to the car, you know what they gave you? Tips.

I was like, “I’ve never gotten this much money,” so I started doing that at a young age. A few years later, I decided to leave that world. When I got out of high school, a guidance counselor said, “You should go to college.” I was like, “I never even thought about that.” Somebody said, “How did you get out of the projects?” My answer is, “I walked out. It was not a gated community. We weren’t prisoners.”

I went to college and fast forward a few years later, I moved to Nashville, Tennessee. I was lending money at 24% interest and taking people’s couches as collateral at this small finance company. When a buddy of mine called one day and said, “You should get into the mortgage industry.” I said, “What are you talking about? I have an efficiency apartment. I don’t even own the furniture and you want me to lend people money for them.”

He said, “No. You’ll do fantastic.” He told me what he was making. I don’t even know if I hung up the phone but I got in the car and drove over. They hired me on the spot and gave me the best piece of advice I ever got in this business. I still use it to this day. My mentor at that time said, “Tim, you got one job? Go find one customer every day.” I was like, “That’s it?” He’s like, “Yes. Stay away from distractions and find one customer every day.”

That’s good. You’ve developed that one piece of advice into a whole coaching curriculum, which we’re going to get into a little bit later as we get into this discussion. I’m interested that you told us about the circle of referrals. What is a circle of referrals? I like the concept. I’ve heard other consultants talking about that. What are your cons of that?

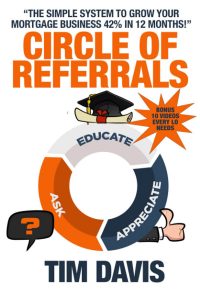

I’ve been blessed to be around a lot of large producers throughout the years. We’re very consistent in their business. Everybody wants to know the secret like, “What does this person do? What does that person do?” Over the years, I looked at it and I said, “They do three things.” It became the circle of referrals. What they do on a monthly basis is educate the market referral partners and they do education.

I call it educate and then the second thing they do on a consistent basis is they appreciate. They’re business partners, they appreciate them, and they appreciate their customers very tangibly. Whether it’s events, note cards, or simple phone calls, they always have something to appreciate them with. Lastly, David, they have a big ask. They are always asking for those opportunities. When I sat back and looked at it, I said, “How do you simplify what all these folks are doing?” It came down to that very simple circle of referrals. You meet people and you put them through that process and it never ends. You keep going.

Marc, I’ll come over to you and ask you part B of that question, which is, how does it work and why is it so critical? Now, let you go into that part of the question, which is part B of that.

Tim, the first thing I want to say to you is that, and David will probably be surprised when he hears, I have never been on a call with someone whose life and early career parallels mine as closely as yours does. I will not take away from your presentation but I’ll tell you this. My mother finished the 3rd grade and my dad finished the 6th grade. I was working at Kentucky Fried Chicken at thirteen years old. I feel your pain. I know what you went through and I salute you for staying with it and getting to where you are now. If there’s anybody who can relate to where you’ve been and where you’re going, it’s me. I wanted to say that real quick.

That’s great, Marc. I always say adversity does 1 or 2 things. It’ll either make you or break you.

That’s right. Relative to what we’re talking about here, we talk about the circle referrals you have, how it works, and why it is critical right now. Can you go into a little bit in-depth about what makes it critical? What are the critical elements of it and how do you see it changing as you go through the process? I am very much a believer that any time we develop something that we use, it is life-changing because it modifies itself as it goes through the process and you learn more about what your intervention with people is about. Can you share that thought process with us?

This is a leadership issue too. We have a lot of leaders out there running mortgage companies or in the field, leading teams, and they’re looking for solutions for people. What people need more than ever are clarity, focus, and a plan. That’s simple. Simple clarity, simple focus, and a simple plan. When you look at the circle of referrals, it encompasses three things, educate, appreciate, and ask as we discussed.

To answer your question, Marc, of what goes into those categories? It varies from personality to personality, but it is all about the relationship. Let’s cover the educate part first. There’s a multitude of ways to educate people. Now, we’ve got all this technology. You could have a show like yours that you educate people through.

You could do videos. The video marketing and the Reels that are out there right now do education through that. Those are great ways to get exposure in the marketplace and then you can host events. We call them lunch and learn. You’ve probably done those in your career. I know I’ve done plenty of them. That’s another way to educate people or you can simply pick up the phone and call people and go, “I want to share with you what’s happening in the marketplace and talk with you about it though.”

Those are ways to educate people. Why that is so important, Marc is when you educate others, you grow and you’re influenced. We all need more of that. We all need more influence to help people say yes to us so we can serve them. There are always ways to change. Back when I got started, I had a shoebox, which was my database. I had birthday cards there. I put and log your birthday in my Outlook and I would reach into the shoebox and send you a card.

When you educate others, you grow your influence. And we all need more of that influence to help people say yes to us so we can serve them. Click To TweetNow we have all these CRMs. Back then, I would go to an office and present, which is still viable, but now I’ve got all this technology to do videos and the likes of what we discussed. There are a number of ways that you can educate people. As technology evolves and things like that, we’ll have new ways to get education out there. I think that answers your question about how it evolved. The appreciate part still remains very tactical. It’s handwritten note cards. In fact, you may see at the bottom part of it, there’s a clock on my wall behind me that was sent to me by a very good friend unexpectedly. He asked for help one time.

I gladly helped him. That helped turn into a large account for him. I was happy for him. He said, “I appreciate it so much. I know you’re a huge hockey fan of the Nashville Predators,” and he sent me this Nashville Predator Jack Daniel’s barrel clock. I’m not saying you have to go that extreme. I thought that was way too extreme. I almost didn’t want to accept it but if somebody is a fan of a sports team, send them an article about that sports team winning. Let them know that you appreciate them on a deep level.

There are numerous ways that you can do that now with technology, but I still don’t want to get away from personal one-on-one. Marc, the last thing is, you got to have a big ask. People need to come up to you and go, “You have a big ask. Did you know that?” and then simply ask for opportunities. If you educate and appreciate enough, that’s the currency where you deposited enough in that personal relationship’s bank account. You’re entitled to a withdrawal.

That works in any environment regardless of the seasons. Correct?

Correct. I think people don’t ask enough. They think simply educating and appreciating entitles them to opportunities. I look at it like this. If you take money to the bank and you deposit it in there, but you never ask them to withdraw it, they don’t call you up and say, “David, do you want to take some of your money out?” I’ve never got that call. I’m sure you guys have never got that call either. When you make these deposits into people and if you don’t ask, you’re not going to get a return and you can grow frustrated.

That’s a great point. Marc, do you have anything else you want to follow up on that?

I want to comment on one of your comments. I learned a long time ago and I’ve tried to hear it in the present that you can’t let social media overtake the interpersonal relationships you have with people. Your idea about sending the notes to people, I learned that probably many years ago in the industry with a guy I work with. He had some note cards printed up with his name on top of him. Anytime he read about one of his friends doing something or heard about it, he sent them a little congratulatory note and all that. He was always good about sending thank you notes to people he thought had done something to help him.

I love it now because my daughter and my daughter-in-law are instilling it with my grandchildren with the idea of thank you notes or saying please and thank you to people. There’s nothing wrong with that. The fact that you developed something like that when you started off where you had that shoebox. I can see it right now. I’m seeing you follow up on things and send them out. It gives a whole core foundation of what you’re all about. I appreciate that and I salute you for that.

Thank you, Marc.

On that note, when you talk about simple notes and we’re talking about technology and how it’s advancing, I want to give a shout-out to a good friend of mine. A new friend, Rick Elmore, who’s the CEO and Founder of Simply Noted. There are tools out there right now where you could type in a note and it will send out automatically a handwritten note. It’s in your writing. If you spend a little extra money to have your writing put into their computers, it’ll follow with amazing accuracy.

It looks like your handwriting and it’s a pen. He’s developed a machine that puts a pen to paper. Go check out Simply Noted. If you want to get ahold of Rick Elmore, all I ask is to tell him I sent you your way. It’s very cool what that technology is. Those are the basic things. Marc was asking about what works now. If it works now or it works at any time in the past, it will continue to work at any point in the future. A lot of these tips you get into your book. Tell our audience a little bit about your book. You talk about six keys to the mortgage business and I’d love to have you touch on that if you would.

It’s a very simple read. Most people can read it in twenty minutes. I’m a get-to-the-point guy. When you get into the six keys of the mortgage business, key number one would be Exposure. I don’t think any of us have enough exposure. We could go into any city and ask agents, “Do you know David? Do you know Marc?” There’s probably going to be some, to our surprise, that have never heard our name before, which means we need to get more exposure.

Number two is Expansion. We’ve seen a lot of that in the past few years. COVID put people into their homes and I saw more loan officers get licensed in other states than I’ve ever seen before. That’s one example of expansion. Others could be more referral partners or going to a county outside of where you normally work and things of that nature. We have to expand our business.

The third one, which has a lot of opportunities for people right now, is called Acquisition. We are in a marketplace where there are people considering retiring, but what do you do when you retire? Do you walk away and have nothing to show for it or would a younger loan officer keep you on the team may be part-time? Could you earn some residuals from your database and the connections that you’ve built up all the years versus walking away from it? We can grow our businesses one person at a time, which I’m a big fan of or we can double overnight by acquiring somebody else’s business that’s retiring.

We can grow our businesses one person at a time or double overnight by acquiring somebody else's business that’s retiring. Click To TweetI’ve been in this for many years. I’ve actually never heard anyone ever talk about that point. That’s a good one.

Nobody ever talks about it, but I did it. When I retired from originating full-time coaching, I sold my database and I was paid out over a three-year period for its production. I still had skin in the game to a degree. The originator I purchased it from did extremely well. I went through it and then during that time, I’m like, “Let’s acquire some other people that are retiring or getting out of the business.” Nobody talks about it, David. You’re right. I don’t know why. That’s a brilliant idea.

Marc, that’s an excellent concept because, with the coaching piece, you added another flavor to it that you can put in there. That’s your mentorship of that person bringing them along. Even though they’re working with your contacts and all, you’re still a person there they can call and talk to about people and processes and benefit from the work they’re doing on your database with your input into it. It could work well.

It can. I guess we’ve never thought about it. We’re taught that this is transactional. We’re broke every day until we find a customer. That’s not true. If you work that and you look for those opportunities, they’re out there. The fourth area would be Offering and Selling Skills, which got dampened a lot during COVID. How did you have to sell to anybody?

It was answering the phone, and who cared if they left because there were ten more calls behind them? Now we have to be educators and sell people on why they should choose us over someone else. Have offers out there. This is something that I’ve always wondered why the mortgage business doesn’t do more of. If you go to the mall any time of the year, there’s a sale. It’s the Columbus Day Sale, the Veteran’s Day Sale, and the Wind Blew From The North Sale. They’ll make up something.

We don’t have sales but I always ran sales in my business. I’m like, “It’s the fourth quarter appraisal lender credit special. You can get a lender credit on your file if you close in the fourth quarter with us.” It’s a way to get conversations started as speaking of offers. For follow-up, how many years have we talked about follow-up in this business? How key and critical it is?

It’s pathetic what we normally do, but it’s such a good point.

It’s so needed right now and then lastly, is Investment. That encompasses not just a financial investment but making sure that you’re financially sound, which you owe to your customers. If your finances are out of order, how do you give advice on the largest purchase to someone else? You’ve got to be financially smart. In this market raise right now, you need to invest in yourself. Your leaders want you to invest in yourself and grow your business through smart investing. The other part of investing is in your personal relationships and your health. We’ve learned in the past years that we need to be as healthy as we can.

In this market race, you must invest in yourself and grow your business through smart investing. Click To TweetMarc and I at our age, know the importance of that. That’s why I’ve got a gym in my home. I work out constantly every day. It’s so important. Tim, one of the things that I’m impressed that Atlantic Bay does is they do so many things well and it’s a great company. I’m encouraging anyone to check it out. They’re creating a coaching program within their company. Not everyone does that. Talk about that program and what it is that you do there.

Internal coaching is taking hold in lots of industries right now. Companies are realizing the importance of having a coach that’s on the team that can bring a lot of knowledge that the company’s already doing. It’s real simple. For example, I’ve coached people at other organizations, but I don’t have access to their numbers. I’m relying on the conversation we’re having on the video or the phone call. When you’re internal, you can pull up records and look at someone’s year-over-year numbers.

I can see their profit margins and basis points. I can see all that stuff of credit pools of what got away from us. Now, all of a sudden, I got a better insight than an external coach can ever have because I’m looking at data. if I’m trained in that area, I can ask you good questions as the leader and as the originator that caused you to think and get movement in the needle. I’ve done this before at other organizations and I’ve seen a 42% growth in productivity and production as a result of it.

That’s a well-worth investment by the Atlantic Bay. Credits to them for recognizing the need for it and for them to bring you on board to do that. You did that for another company that’s well respected out there. We’ll leave the name out but Atlantic Bay was very smart to bring you on. Thanks. I appreciate that. Marc, let’s have you take the second to last question there, and then I’ll handle the last question. We’re then going to go free and then we’re going to go off script into some of the things that I’ve got in my mind as I’m listening to you talk to him. Go ahead with the second to last question that’s published.

This last question is, to me, one of the key questions that were on the list. It is basically asking you what two areas every loan officer should focus on. Fine-tune it down to two things. What are the top 2 things or what are the 2 things that every loan officer should focus on?

If we talked about the six keys, they need more exposure and expansion right now. That’s two keys but in all reality, they need to focus on their personal growth right now. You’re only going to go so far as you personally grow. Marc, your background and my background is proof of that with our family and where they got to versus where you were able to get for yourself. That came through personal growth. That is incredibly important to folks. That even includes your mental health as you go through the marketplace.

For a lot of people, it’s brand new to them. They’ve never seen a 6% or 7% rate. I got into this business at 11%. Personal growth and mental health are super important. The other area that they need to focus on is being productive every day. We went through years of people sitting in their pajamas taking phone calls. We got away with it by getting out in the field, shaking hands, kissing babies, and having those meetings. That’s an area we all need to improve in. Get back in the habit of doing that.

That’s a great point. Now you have a magazine, The Originators Guide Magazine. I’ve got three copies of it here. When you and I met in Nashville at the National NBA Conference, you had a booth there. I stashed these up and I read them on the way home. They’re excellent magazines. Talk about them. What’s your focus and why do you publish them?

It goes back to the circle of referrals quite frankly. Key number one is to educate. How do you position yourself as an educator? I do it a number of different ways but there was a gap in the marketplace. What happened during COVID, we published a marketing magazine for loan officers to give to real estate agents. It was a physical copy and everybody kept pushing me, “Tim, why is it not digital?” I said, “It’s because if it’s digital, it’s hidden behind a computer screen. If it’s physical, it sits on somebody’s coffee table or on their desk. You’re always top of mind.”

“Who wants to go to their mailbox and get another bill? No, they want to go to their mailbox and be rewarded with a nice magazine.” I noticed there was a gap in the marketplace of a printed magazine for loan officers that would help them with strategies and techniques from their peers and industry thought leaders that were affordable, I could get in their hands, always stay with them, and be a physical copy. Nobody was doing it. I said, “That’s an opportunity for us to educate people, so we started it.

It’s a quality magazine. The quality of the paper and the printing is something to be proud of. The content, it’s great to have paper and all that stuff, but it comes down to what is in there. One of my favorite articles I read on that is one of the people I have the privilege of coaching. It’s your boss and good friend, Emily Farley. I love how Emily talked authentically in this and gave some great tips. I encourage people to pick up every one of your publications and monthly subscriptions. I want to talk about that in a minute, but get Emily’s because it was excellent. How can people get signed up for your magazine?

It’s simple. Our website is TheOriginatorsGuide.com. They can go right over there. They can listen to our podcast or click on the button that says Magazine. Right now, if they purchase a subscription, we give them a free T-shirt on top of it that will help their sales page.

I got to have a key tease about this. When I saw Tim at his booth, he was wearing this colorful blazer and it’s signature to you. It’s on a lot of your content out there. What’s the story behind the blazer and all the colors? It’s so colorful.

When I was originating that, I would teach a class called Personal Branding. I still teach that now and we would bring agents in. We have a saying in the class that is the same as lane. If you’re not in a conversation, you don’t have a chance. You’ve got to get in the conversation and build rapport. How do you create conversations out there? Some people are shy. I started off years ago with colorful socks and I would label my socks.

This is my Monday morning meeting sock and this is my Tuesday big deal sock. I started noticing other people would start posting socks and tagging me like, “Tim, look. I got crazy colored socks.” I thought, “You’re still in my thunder. Now we’re the same.” I found this jacket and I do what anybody else does. I went to social media and posted a picture to see what everybody else thought. I said, “I’m buying it and I’m going to start wearing it.” Nobody else has shown up in a jacket like that.

I might understand why. You got to see this coat. It’s a coat of many colors. It is something to be called. In fact, I was talking to Emily. I was texting her and I go, “Where’s Tim’s booth? It says it’s on aisle such and such.” I walked by your booth so many times. I don’t know why, but it was a couple of things the way it was just so dramatic. I love the energy that you bring when we are to gather.

You to do something, which is a daily brief three-minute podcast. That captures me. He says, “Dave, would you like to do a podcast right now?” I go, “Where’s the booth? How are we going to do this?” He said, “No.” It was communicating frequently and effectively to your base. Talk about that. How did you come up with the idea and what would you recommend others do like that?

Another one of the concepts we teach in our branding class is that the frequency of visibility increases influence. If you’re going to do anything social-wise and you’re only going to do it once a week, you’re going to delay your ability to get more exposure. Look at Gary Vee. How many videos does he post? Who has time to do all this stuff? I did exactly what you’ve done, David. I bought all this equipment. I had fancy microphones. I had all.

The Circle Of Referrals: Frequency of visibility increases influence. If you do anything social-wise and only do it once a week, you will delay your ability to get more exposure.

I looked like I was going to record a record in Nashville. I had it all set up and I did nothing because after I bought everything, I was intimidated by all of it and then I realized something. In this life, there are no rules. We had these rules in our mind like, “If I write a book, it has to be hardcover and in Barnes & Noble.” That’s not true. You can write a book and publish it on Amazon and it can be a picture book. It doesn’t even have to have text in it.

That hit me about the frequency of visibility and simplicity. I found an app. It’s free. It’s called Anchor. Their website is Anchor.fm. Anybody can sign up and create a podcast. I then realized there are no rules on podcasts. The National Association of Podcasters of America, which I’m not even sure applies, but let’s say it is, never said that your podcast has to be 30 minutes and distributed to 30 channels in order for it to be legitimate.

Nobody has ever said that. I found this little app and realized that the microphone on your iPhone is incredible. It’s good. I said, “I’m going to start a podcast.” A few years ago, I started it. Because I’m busy and running a lot of things, I said, “I need a hook. Why would somebody listen to my podcast?” My hook was to get a coaching tip Monday through Friday in under three minutes or less. That was my marketing hook on it. I said, “I can do a tip every day in under three minutes.” Most of the time, I’m going to be honest, I’m in the backyard letting the dogs go to the restroom in the morning when I record the podcast.

It’s the spontaneity in the inspiration. I’m not sure the dogs are bringing the inspiration, but maybe being outside in the fresh nature and getting the fresh slots is doing it. Marc, it was brilliant. I look at what Tim has done. Part of your story that’s so heartwarming is where you came from and what you came out of. For someone who’s tuning in, I’m real passionate about bringing the next generation of mortgage bankers into the industry. What would you recommend to someone who is considering getting into the industry? Many would say, “Why would you get into it right now? It’s terrible. There’s no business out there.” What would you say to someone now that they should get into the mortgage business?

It’s incredibly rewarding in a number of aspects. You obviously have the financial reward of it. You have the freedom and flexibility if you can grow your business correctly after putting in a lot of work but here’s what I said. I said this at a luncheon to real estate agents one time. We think we sell money and houses. That’s not true. What we do is provide an opportunity for a family to have those pictures around the Christmas tree in December.

You have the freedom and flexibility if you can grow your business correctly after putting in a lot of work. Click To TweetWhat we do is provide a family with a backyard to put the swing set in. We’re memory creators. We’re providing the funds or the contract to help them create those future memories. Growing up in the housing projects, I’m sure Marc can relate, I didn’t have my own room. We didn’t have our own house. We lived in housing projects.

We helped people create wealth and a future but beyond all of that, over the next several months, we got out of Halloween, we’re coming into Thanksgiving, and we’re heading into Christmas. Take a look at your social media and look at all the pictures of the families gathered around tables. That’s what we’re part of. If you want to be part of something that makes a difference that’s still living an American Dream that can be rewarded financially and freedom to you, it’s a great career.

I always refer to mortgage lending as the fourth most transformative thing you can do for someone’s life. Marc, you were about to say something.

I’m telling you that you hit the nail on the head. You’re selling family, pride, and self-actualization. All those things that make a person successful, have a great family, and build that family for the future so that those folks can be successful too. I salute you for that. I would like to circle back on two things you said because they’re so important. I want you to make a point about them.

When you talked about the two areas and whatnot, and you talked about folks sitting in their pajamas and taking applications or talking on the phone in one thing, that was so true. David and I, being students of politics like we are and we talked about politics a lot, what we found out from politicians is that successful politicians run for office and win. They keep on campaigning after they won because they’re campaigning for the next election.

Those that stop and don’t do anything two weeks before the next election is going to be the losers and things. That’s like a loan officer. They got to stay with it. When you give all these loan officers out there these Originator Guides with cues, things, and tips to follow, you’re helping them because you’re keeping them on their toes. I see the formula that you developed and the things you’ve done. Having a great impact on the industry, I salute you for what you’re doing. It’s good to get to know you.

Thanks, Marc. That’s too kind of you. I appreciate it.

How do people get in touch with your podcast? How do they find it? It’s over there in Anchor, but is there an address? Do you have a unique URL for it?

If you go to TheOriginatorsGuide.com, you can click on the button on the homepage and it will open up Spotify or Apple Podcasts and you can subscribe to it. It’s on all the channels but going on the website is the easiest.

One of the things a lot of people say, “I see so many loan officers struggling with the work-life balance.” You’ve got a great marriage and an amazing gal. She designed your background there and your home. I love how you talk about your wife. What do you say to those that are struggling with a work-life balance? Do you coach on that?

I do. If you have to marry a spouse that’s stronger than you, that will put you in your place. It works out a lot. I’m petrified so I get my button gear. The problem with our industry is it can be a drug and it can become very addictive. When we first start out in our careers, we unintentionally paint ourselves in a corner by saying, “I’m open 24 hours a day. Here’s my cell phone. Call anytime for anything.”

It’s because we need opportunities. We’re unknown. We’re trying to get somebody to give us a shot so we’re open 24/7. Unintentionally, that creates a mental problem that we are the center of the world of mortgages later in our careers and then that shows up in our family time. In order for me, I’ll have the stake but I got to step out and take this cost my very best agent and this initial startup that creates it.

We form this mental picture in our mind of like, “We’re everything to everybody,” until we can break that. I know originators that still to this day work ridiculous hours and have broken homes. Externally, they’re successful. We applaud them and we’re like, “Look at that volume.” Internally, they’re broken. Unless somebody comes along and talks with them about that and gets their attention, it’s a damaging thing.

You had a very successful event in Nashville right there in your hometown. Emily was telling me about it. She goes, “This thing and the content, Dave, was outstanding.” It was way better than any other sales-type conference she’d been at. She says, “It’s going to double next year in size and double again after that.” You’re the new mastermind of what you built there. Talk a little bit about that and why you think it was so successful. She said it was content.

The number one thing that would make anything successful is you have to put yourself 2nd and your audience 1st. Whether you’re doing a podcast, a magazine, a book, or whatever, you have to look at it from your audience’s perspective. What do they want? What do they need? What would they enjoy? You should always be second in that. Yes, you’re on the stage or whatever. That’s irrelevant. It’s what they get from it.

You have to know your market conditions and you have to bring in content that will help those market conditions. You design it in such a way that there’s comedy and entertainment mixed in with reality and emotion. It’s like crafting a movie. There are parts of the movie that you’re watching like, “I’m entertained,” and then there are the sad parts. That all goes into it. It’s a little bit deeper than maybe we want to go into here. The simple thing to say, David, is that you put your audience first and you’ll always win it.

The Circle Of Referrals: You have to know your market conditions and bring in content that will help those market conditions.

It’s a great conference. How can people learn more about it? I’m sure you’re going to do another one in 2023, hopefully. I want to be at it.

I told Emily, “Let’s capitalize on the momentum. Let’s do one in the spring.” She’s like, “What about twelve months from now?” I’m like, “I don’t know what’s going to happen twelve months from now. Let’s do one six months from now.” The Facebook page is Music City Sales Summit or you can go to the website, MusicCitySalesSummit.com.

It was excellent. It was well done. Of course, Nashville is one of my favorite places to go for a conference. Tim, I can’t believe how fast time has gone here. Marc, are there any questions as we’re wrapping this up that you would like to ask Tim?

No, but I will tell you that this one is an adorable conversation I’ve had for quite some time.

We appreciate you taking the time, Tim, to join us here and share. I want to have you back and I encourage our audience to check out the magazine and the podcast. More importantly, get to know Tim on a one-to-one basis. If you’re looking for a good coach when it comes to sales and marketing and how to get out there, Tim is someone you got to talk to. For people to go to your website, Tim, what’s the best way?

TheOriginatorsGuide.com, you’ll find everything you need over there.

Thank you so much, Tim.

I appreciate you, guys.

Important Links

- Atlantic Bay Mortgage Group

- Marc Helm – LinkedIn

- The Originators Guide Magazine

- Emily Farley – LinkedIn

- Anchor.fm

- National Association of Podcasters of America

- Anchor – The Originators Guide Podcast

- Spotify – The Originators Guide Podcast

- Apple Podcast – The Originators Guide Podcast

- Music City Sales Summit – Facebook

- MusicCitySalesSummit.com

- https://www.LinkedIn.com/in/TimDavisOnline/

- http://SuccessKit.io/

About Tim Davis

Tim is an “at-risk” kid from the housing projects who got introduced to the mortgage business. After many years of success as an Originator, he now dedicated his time to helping originators grow personally and professionally through his podcast, coaching, seminars, and magazine

Tim is an “at-risk” kid from the housing projects who got introduced to the mortgage business. After many years of success as an Originator, he now dedicated his time to helping originators grow personally and professionally through his podcast, coaching, seminars, and magazine