In this episode of Lykken on Lending, David will interview Tom Gallucci who is Vice President of Business Development with The Mortgage Collaborative, with the aim of discussing what’s going on at TMC these days.

Want to know more about Tom Gallucci?

Tom joined the cooperative in 2016 dedicated to continuing to grow out and managing TMC’s Preferred Partner network of 65+ best-in-class solutions providers to the mortgage industry. During Tom’s tenure, TMC has grown into the nation’s largest independent cooperative supporting independent mortgage bankers and community banks.

Prior to joining TMC, Tom spent the prior 10 years in varying roles in mortgage sales and operations, in addition to financial services roles at organizations including Bank of America and Huntington National Bank.

Register NOW for…….TMC’s year-end event the “12 days of TMC”

NEWS UPDATE:

Black Knight (click to blog post) news update from Mitch Cohen, Corporate Storyteller, Narrative Strategist & Director Of Public Relations at Black Knight, talks about our weekly forbearance numbers….

Highlights from the data:

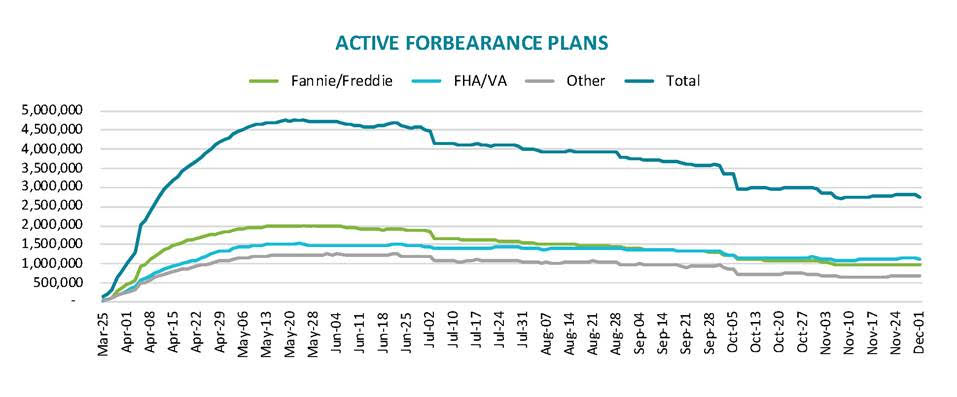

- There was a modest decline in the number of active forbearance plans this week

- This decline was likely driven in part by the 200K forbearance plan expirations that were scheduled for the end of November

- Active forbearance plans fell by 39K for the week, with GSE forbearances falling by 25K and FHA/VA forbearances falling by 14K

- The number of active forbearances among loans held in banks’ portfolios or private label securities held steady this week

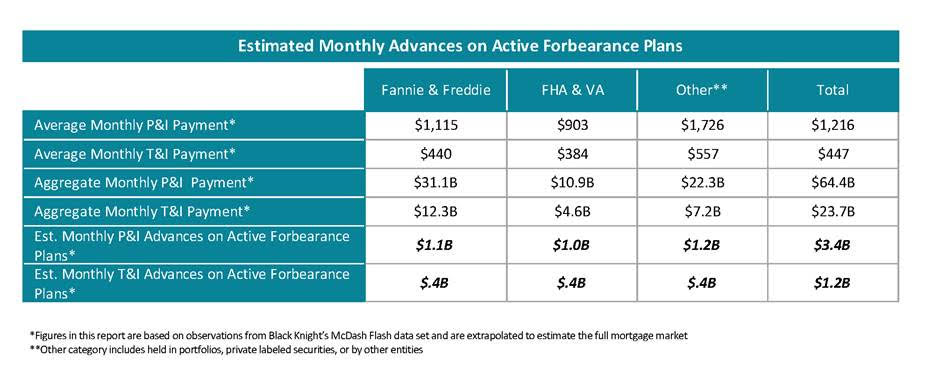

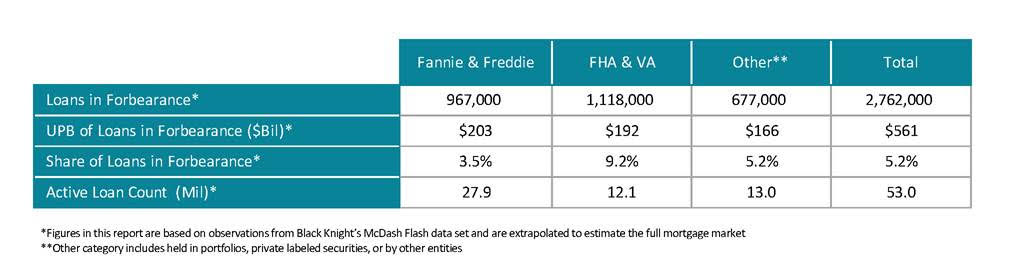

- As of December 1, 2.76M homeowners remained in active forbearance plans, representing 5.2% of all active mortgages.

- Overall, forbearances are now down 91k (-3.2%) month-over-month

- While November saw comparatively limited forbearance expiration activity, more than 1M plans are scheduled to expire in December, representing nearly 40% of all active forbearance cases

- 81% of forbearances still active have had their terms extended at some point since March