In this episode of Lykken on Lending David will interview a special guest for the Hot Topic segment with the aim of having a discussion on how Digital Mortgage and user experience need to go hand in hand in improving underwriting, creating more satisfied borrowers, and more happy and productive employees.

Many lenders have been migrating to technology-driven underwriting tools to automate the underwriting process while creating efficiencies, reducing errors and improving processing times. But the fact is, digital data and document automation only help if the underwriter has an overall better, more efficient user experience.

Given that underwriters are some of the most highly compensated and important pieces of the mortgage origination process, how user experience impacts job satisfaction and employee burnout is an incredibly important consideration.

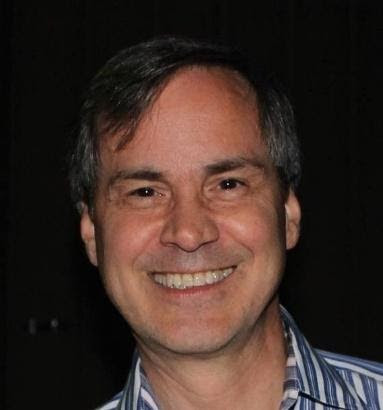

Quick background of…..

Frank Poiesz, Managing Director of Product Development for Black Knight Inc. Origination Technologies division responsible for its digital origination products and the company’s artificial intelligence platform – AIVA. Frank is a mortgage banking innovator with a 30+ year track record of delivering technology solutions for origination sales, operations and capital markets. In addition to leading businesses with a constant focus on process improvement, Frank has designed and implemented production systems for large and small financial institutions. He joined the Black Knight team through the Compass Analytics acquisition in September 2019. His most previous role was Compass’ Chief Revenue Officer responsible for sales and marketing. Frank’s career includes managing a loan origination practice for a boutique consulting firm and overseeing several consumer-facing technology platforms at a banking subsidiary of a large investment bank. He was also in retail banking in several roles including bank president, CFO and operations leader.

Talking Points:

- What is your unique experience as it relates to underwriting?

- Underwriting to evaluate risk involved with originating a mortgage.

- Best way to approach inherent risks associated with underwriting?

- What do you mean by improving the underwriters’ experience?

- Risk’s automated underwriting could put an end to the profession?

- Black Knight being a leader in innovation, what is company doing?

ANNOUNCEMENT: